Special Report: COBOL Survey Results Prove Pervasiveness, Value and a Bright Future

“Housework is something that nobody notices unless you don’t do it.” So the old saw goes. And it’s easy to see why—or rather to fail to see when you can just take it for granted. In the same way, looking at the limited general awareness of COBOL’s role in the world of digital commerce, one could paraphrase that aphorism: “COBOL is something that nobody notices unless you try to replace it.”

Well, as mentioned in my previous article about this, it’s time everyone saw what COBOL professionals see—that COBOL has become the fulcrum of business IT, and those who stay and benefit outweigh the leavers.

Fine Tuning the COBOL Working Group’s COBOL Survey

But how do you tell people, whom do you tell and what do you tell them? And when you’ve seen your way through to getting the gears turning on that, you won’t be content without relevant content to share. So it was that the COBOL Working Group (CWG) of the Open Mainframe Project (OMP) rolled out their survey after weeks—months, even—of careful consideration and design. Some of the pre-questions that had to be answered before even generating the survey questions included:

- What needs to be known about COBOL that would be of value to share?

- Who can provide this important information?

- How can they be reached in order to get their responses?

- What can be done with the information gathered to reach relevant conclusions?

- How can the insights gathered be disseminated and used beneficially?

This resulted in a fine-tuning of the survey down to a small enough set of questions that they could be answered in one sitting, while still covering the most important information, such as:

- Job role and experience level of the respondent and willingness to discuss their answers further

- Respondent’s organization’s size and category (e.g. finance, manufacturing, distribution, retail, government, etc.)

- COBOL context of their organization—relative and absolute size of COBOL portfolio, current and projected shrinking and expansion of COBOL presence, and location and sufficiency of current and anticipated COBOL development workforce

Analyzing the Data

Finally, the survey went live, and it was rolodex time, as each member of the CWG worked to locate contacts and contexts for sharing the link and a request to respond in a timely fashion. OMP participants, relevant community boards, Facebook (including the COBOL Programmers group with over 21,00 members), LinkedIn contacts and groups, other professional contact lists, professional bodies, Marist college associates, and members of user groups such as SHARE and GSE were sent invitations. And hundreds of responses were received before the deadline. The time had come to analyze the data.

That turned out to be a major undertaking, as key team members mentioned in the previous article dug into the task. Weeks later, a compelling picture began to emerge of the world of COBOL today and in the foreseeable future. As for what to do with that data, the results were summarized in a presentation to the OMP Summit on September 23, 2021, and will be presented at various levels of detail on many upcoming occasions. You can even view a webcast presentation about it by the OMP CWG here. But today you get to read the first deep dive into the results.

Three Key Findings

Before digging into the details, what may be the three most significant results bear special attention.

1. 250 billion lines of COBOL in use

The first of those is the amount of COBOL in production use in the world: 250 billion lines, based on our extrapolation! That’s apparently the largest it’s ever been, and slightly larger than the 240 billion that some estimated in the 1990’s. Some folks take this to mean that COBOL’s not going anywhere, while others point out that it is indeed going somewhere—just not “away.”

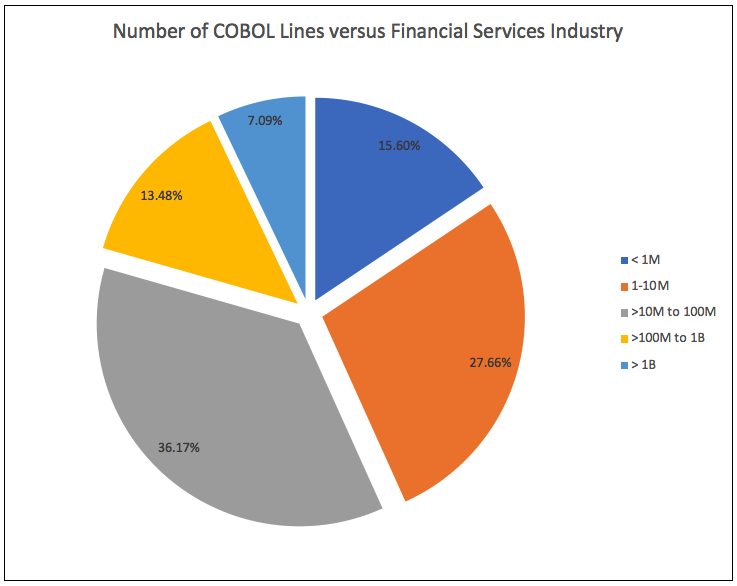

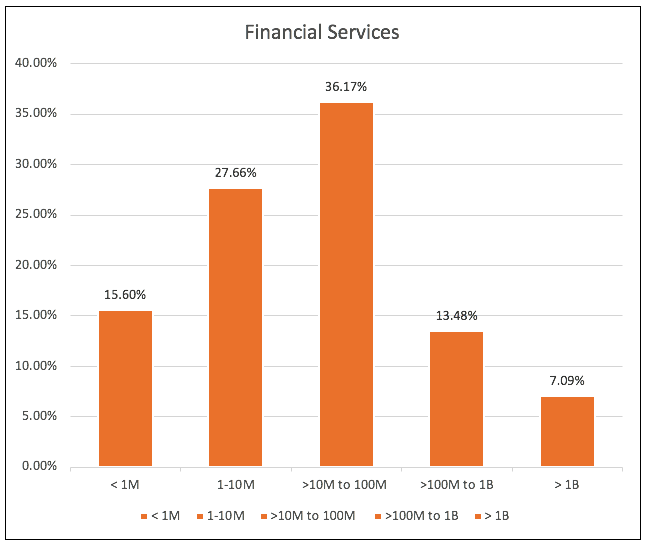

In figure 1, below, we see an illustration of this from one segment of the COBOL-using world—the financial services industry, broken up by number of lines of COBOL per individual organization surveyed. At the extremes, over 15% of such organizations had fewer than one million lines of COBOL, while slightly more than 7% each had over a billion!

The sheer inertia of such a massive investment in this legacy that works so well, and is so deeply optimized and rooted, alone is proof that COBOL is here to stay – and is a permanent going concern – again, just not “going away.”

2. The future of COBOL is bright

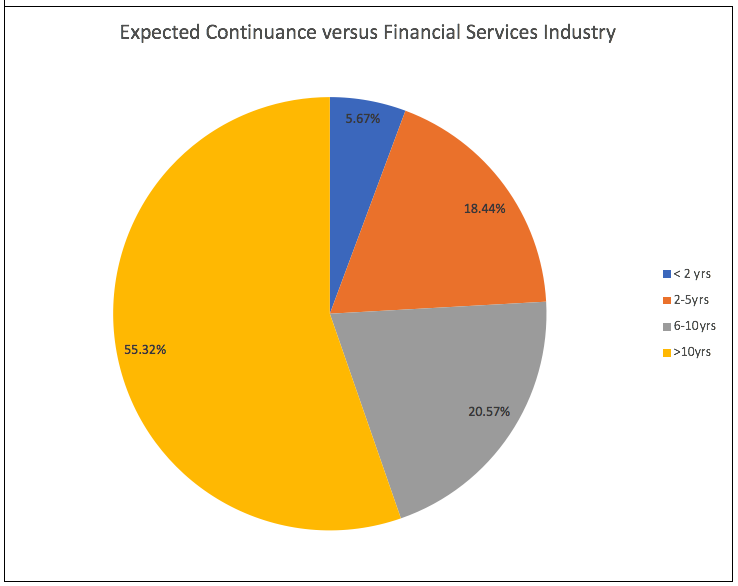

The next major finding, which, given the above proof of the inevitability of COBOL, seems typically conservative of those who work in the business contexts where it runs, demonstrates that even among this too-pessimistic crowd, the future of COBOL is recognized as bright and persistent. Fully 58% of respondents were willing to admit that their COBOL applications will be sticking around for the next half decade or more.

Figure 2 illustrates this, demonstrating an even greater optimism among respondents from the financial services industry, where over 55% expect them to stick around for indefinitely more than the next decade.

3. The COBOL skills challenge

The third major highlight is the skills challenge. In a way, this is almost funny, given how COBOL was designed to be an easy language to write and read, and not require advanced computing abilities to learn and develop with it. Organizations that have their own internal training programs need not spend their time worrying where they’ll find new COBOL programmers—they can just hire competent and willing new staff and get them proficient and functioning in an acceptably finite time. This interview of two young COBOL programmers is a perfect illustration of that fact.

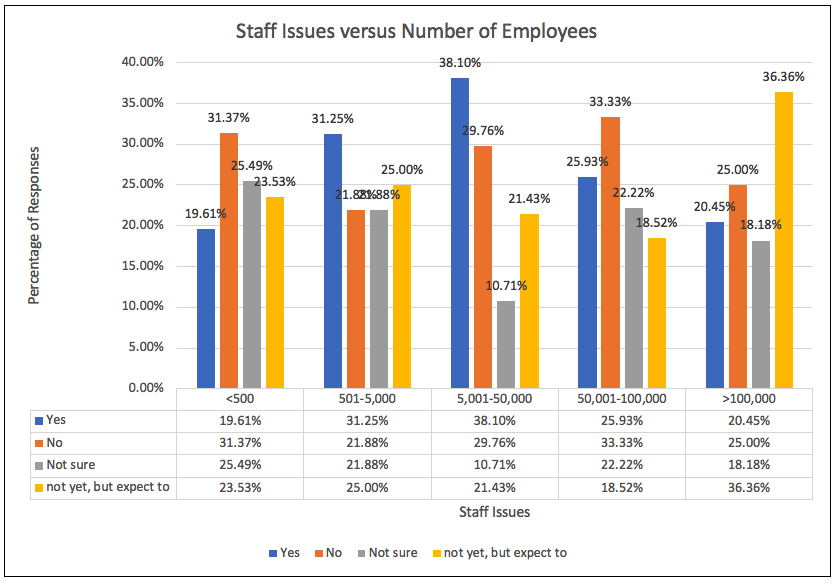

Be that as it may, as figure 3 illustrates, people are worried about it, and that certainly shows how important and persistent their investment in COBOL is. And while it’s interesting that organizations at the extremes (fewer than 500 employees or more than 100,000) have relatively lower degrees of immediate concern than those in the middle, no more than a third of any group have no concerns about COBOL staffing.

Survey Responses by Role

Of course, if those are the highlights, there are many more insights to be had. As the various answers were combined and compared and separated out by dimensions, a number of things became apparent, the first being how different each of the constituents—both individuals and organizations—were in some areas.

The roles that were tracked were:

- CIO/CTO

- VP of Applications

- Applications Manager

- Programmer/Analyst

- Application Customer/User

- Other

Of these, the substantially largest number of respondents were Programmer/Analysts, followed by Other and then Application Managers. There was the smallest number of Application Customers/Users, and their responses were notably different from the others.

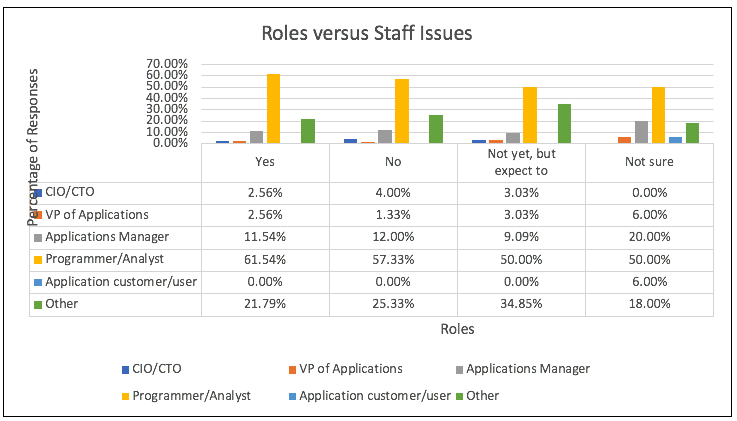

The CIO/CTO and VP of Applications roles had a smaller but very significant number of responses, which showed distinctive perspectives contrasted both with each other and with the other roles. As an example, in figure 4, we see that CIO/CTO and VP gave similar numbers of responses of “Yes” and “Not yet, but expected to,” but the CIO/CTO roles were prone to give a notably higher response rate to “No” while completely avoiding admitting they were unsure, which is completely at variance with the VP of Applications roles. Meanwhile, Application Customers/Users exclusively answered that they were not sure of the situation.

Survey Results by Industry

The industry segments that were specifically called out were:

- Distribution (Logistics)

- Financial Services

- Government

- Manufacturing

- Software Vendor

- Retail

- Other

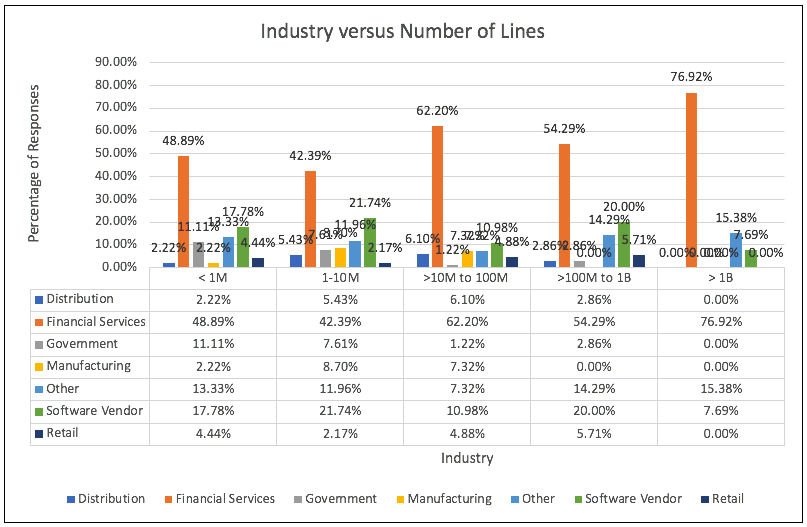

Of these, easily the largest number of respondents were from Financial Services organizations, though all were well-represented. The number of Financial Services respondents was so large as to overshadow the other responses on nearly all value ranges, but taken in the aggregate, a personality of each segment still begins to emerge. Figure 5, a chart of number of lines of COBOL by range and industry, illustrates this:

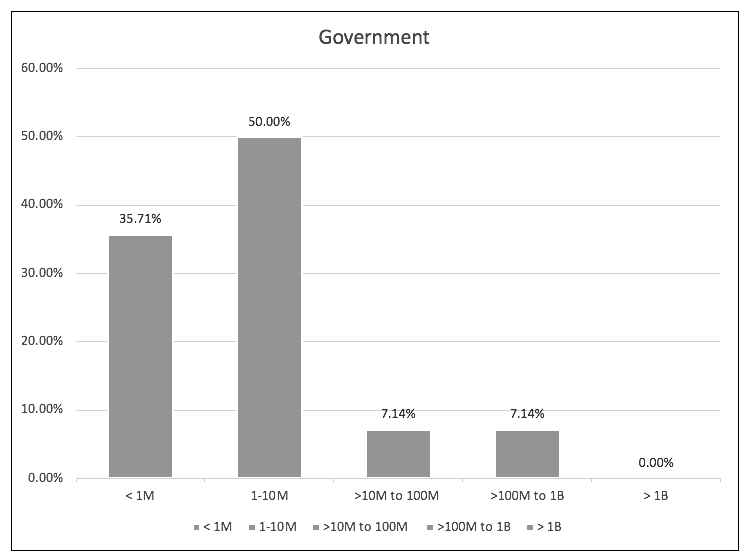

Other than the lopsided relative proportions, the above chart also allows us to see where each of these segments plays, with only organizations that identify as Financial Services, Software Vendor, and Other having over a billion lines of COBOL code. Digging into specific industries in the two below example charts (figure 6 and figure 7), we can see that, on the one hand, the Financial Services industry had the largest percentage of respondents with 10 to 100 million lines of COBOL, while on the other hand, Government respondents were more prone to have fewer than 10 million lines, and none of those surveyed claimed to have over a billion lines.

Pulling Together Industries and Roles

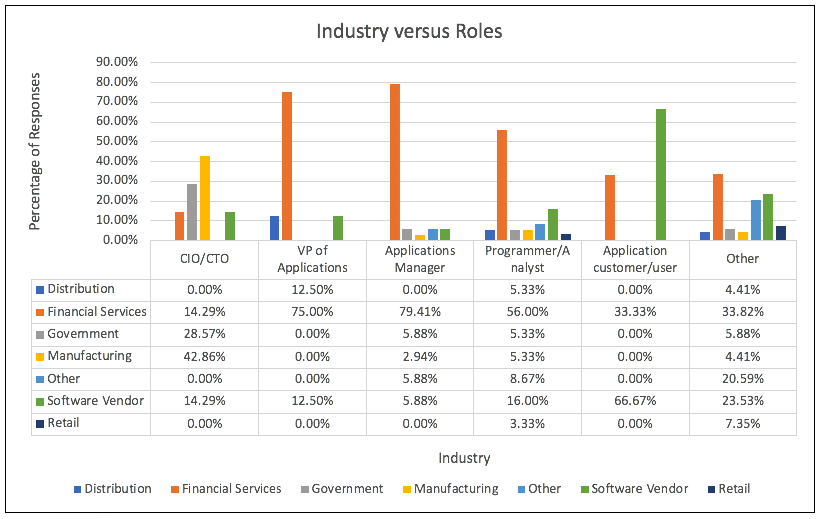

While hundreds of such charts resulted from this study, we’ll leave it for a more exhaustive document to contain them all. However, one more chart (figure 8) sheds important light on the nature of the respondents and their organizations—specifically, the one that compares them:

As we can see, CIO/CTO respondents were from everywhere but Distribution, Retail, and Other, while VPs of Applications were only from Distribution, Financial Services, and Retail. In fact, the only two industries that were represented by all six roles were Financial Services and Software Vendors, while Retail was only represented by Programmer/Analysts and Other, which therefore turn out to be the only two roles represented at every industry.

Additional COBOL Survey Messages

So, having set the stage, here are more messages that the massaged data measures out to us:

Staffing concerns by industry

Where COBOL staffing concerns were considered, the industries that had the highest “No” response rate were Retail and Software Vendors, but the total of “Yes” plus “Not yet, but expect to” at all industries was equal to or greater than the “No” responses. The former combined value ranged from a high of 58.62% (Other) to a low of 40% (Retail) while “No” ranged from 16.67% (Distribution) to 40% (Retail). But most fascinating was the wide range of “Not sure,” as follows:

- Software Vendors: 10.87%

- Financial Services: 16.2%

- Retail: 20%

- Manufacturing: 20%

- Other: 24.14%

- Distribution: 33.33%

- Government: 37.5%

This range from security to uncertainty suggests that software vendors and financial services providers may be more focused on the immediate implications of mass retirements, while logistics and government entities might be more prone to be focused on other issues still.

Another way of looking at the staffing concerns is by number of employees at each organization represented. Here the data divides neatly into three groups: organizations with under 5,000 employees, those with between 5,000 and 100,000 employees, and those with over 100,000. The first group and the last group also are very similar as distinct from the middle one: the number of yes responses is around ¼ of those surveyed, and combined with “not yet, but expecting to” ranges from 48 to 54%. In the middle ground, the yes answers are around 35%, and combined with “not yet” add up to around 57%. The “not sure” answers all fall in the 14 to 22% range.

This gives interesting perspective, combined with the third chart in this article, on which organizations’ representatives see an imminent demographic capsizing of the legacy COBOL/mainframe workforce as relevant.

Where organizations are getting COBOL personnel

Related to the above point is where organizations are planning to go to get their new COBOL personnel. Respondents were given eight choices:

- University

- Community College

- Send Internal Resources to Boot Camp

- Internal Training Program

- External Resources

- Experienced Hires

- Don’t know/not sure

- Not relevant

The first pair, which had remarkably different ranges of response, combine to show how much faith there is in the educational system to produce new COBOL programmers. The highest combined total for both options was 16.94%, but to be clear, University had a much stronger showing, with no industries giving a higher score to Community College, and two (Distribution and Government) having 0% that indicated Community College. Given my personal experience that community colleges are currently more likely than major universities to teach mainframe and/or COBOL, that’s a pretty serious disconnect.

The next pair essentially amount to taking ownership of developing a new generation, either using internal training or by sending new employees to a boot camp. That’s the proactive approach, and between 9.52% (both Distribution and Government) and 34.57% (Software Vendor) indicated this was their approach, though three (Distribution, Manufacturing, Retail) had 0% of respondents choosing boot camps, and none preferring them over internal training.

Those who chose to hire or contract external and experienced resources, assuming they’d be “out there” (perhaps assuming an outsourcer or personnel agency would handle it for them) were the largest group for every industry but software vendors, who had a higher tendency to train their own. Ranging from 34.57% (Software Vendor) to 61.91% (Distribution), only Government showed a preference of External Resources to Experienced Hires (33.33% vs 19.05%).

Finally, those who didn’t know or didn’t care (“Don’t know/not sure” and “Not relevant”) ranged from 14.81% (Manufacturing) to 29.7% (Government), with a consistent preference for being unsure versus not considering it relevant. The extreme case of this was Retail, the only responded with 0% “Not relevant,” contrasting with their 25% of respondents being unsure.

COBOL application portfolios

Another area of substantial interest is what percent of a given organization’s application portfolio is comprised of COBOL. Here, Retail, Software Vendors, and Other had less than half of their portfolios in COBOL, ranging between 44% and 46%, while Government and Financial Services were 50% and 53.33%, respectively, of their portfolios in COBOL, and Financial Services and Distribution were remarkably 73.24% and 91.67%!

That’s right: the smallest amount of an application portfolio in COBOL by industry was 44%, and the largest was 91.67% by industry. You heard it here first, folks: COBOL is still the main language for business processing!

Onshore and offshore COBOL maintenance

On a more humorous note, the responses about the question of how much COBOL maintenance is done onshore vs offshore showed a reality that is quite different from many perceptions, and even illustrated this. When broken up by the roles of those who answered, more than half of all respondents in every role but Applications customers and users indicated that all COBOL maintenance is done onshore, and only Applications Managers, Programmer/Analysts, and Other had any responses indicating that it was all offshore—ranging from just under 12% to just over 15% of respondents. No other role had any responses indicating that everything was offshore. But, and here’s the funny one: Every one—100%—of the Applications customers and users indicated that it was a combination of onshore and offshore. In other words, it appears that they didn’t actually know, but assumed that there was some offshore maintenance!

Sunsetting COBOL applications

Speaking of longevity, one interesting indicator of the persistence of COBOL is how many applications are being sunsetted. The ranges to choose from were none, three or fewer, four to 10, and more than 10. Given the substantial number of COBOL applications that a large organization is likely to have, it might be suggested that a much wider range of choices than just “more than 10” might have been appropriate at the high end. Not so! The range, by industry, for answers of “none” was from 30% (Retail) to 57.78% (Software Vendors), and combined with “three or less” ranged from 59.15% to 80% of all industries – that’s amazing! In contrast, whether they were sunsetting 11 applications or 110, or more, the total percentage respondents sunsetting “10 or more” COBOL applications ranged from 8.33% (Distribution) to 33.33% (Manufacturing), with most answers being closer to 10% than 30%, but none being more than a third.

Again: COBOL is not going away. For that matter, those few applications being sunsetted may well be replaced with other COBOL applications if any replacement functionality is needed.

Respondents’ willingness to be contacted

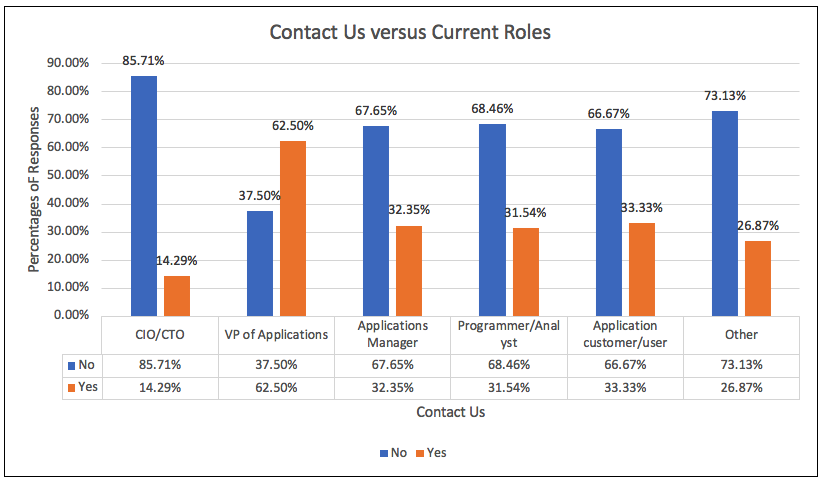

One last relevant, and somewhat humorous, data point is the number of respondents who were willing to be contacted to further discuss their answers. By every measure but one, every group of respondents had people willing to discuss their answers, but a substantially larger number who weren’t. The one exception was VP of Applications, where nearly twice as many respondents were willing to be contacted as weren’t! Now that’s a cohort that wants to get the word out, as illustrated in figure 9:

COBOL: Alive, Well and Ready for Investment

While there are many more combinations of data points and responses that will lead to ongoing growth of insight into the COBOL aspect of the legacy computing ecosystem, it seems fair to say that the above measures give us a clear picture of COBOL as a going concern that’s not going away, but one that people need to do a lot of catching up with.

This is a very big deal. When COBOL was first designed in the late 1950’s and released to the world at large at the beginning of the 1960’s, even its detractors added to its popularity with the energy of their opposition. For subsequent generations, COBOL became embedded in the world economy as the language that makes business run, but it works so well that, just like consistent housework, everyone stopped noticing it. So it didn’t become unpopular so much as taken for granted, and practically invisible as a consequence.

Finally, a group of enthusiastic and expert COBOL afficionados have done the digging to find out the facts about COBOL’s role, pervasiveness and momentum, and the results are earth-shaking. Not only has COBOL not gone away, but nothing else can touch its definitive role in the past, present and future of business IT, with hundreds of billions of lines and the largest of organizations utterly reliant on it, if not always as engaged with this fact as they will consequently have to become.

It appears that we have reached a tipping point, and this survey might just be what finally tips the digital economy’s participants into self-awareness and strategic proaction to build on this definitive, foundational language, code base, and global constituency.

The time has arrived to move forward with what works so well we can’t proceed without it, and to support every participant in the global economy in catching up with these facts.

Congratulations: by reading this article you just became part of the cohort of individuals who are doing that catching up. Now go out there and tell everyone the great news that COBOL is alive and well, and is ready for investment!